Introduction

Wise, formerly TransferWise, is a digital payments system that was established in 2011. The company advertises itself as one of the best payments transfer system in the world, and they have been partnering with multiple businesses since their establishment over eight years ago. One of the drawing factors of the company compared to other similar services is the lower charging fees that they impose, and the avoidance of higher bank fees when conducting money transfers. The company uses local bank accounts around the world, and transfers the money to another bank account, acting like the middleman. The company was able to slowly change how interbank transfers are made, and they gave the public a favor by freeing them from the slow and costly transfers made by international banks.

When using the services from the company, a person from a specific country would only have to download their application or visit their website to start transaction. Details such as the recipient’s primary information and the exact amount that will be sent are required. The sender should also include their debit card information when sending money. Alternatively, senders can use their respectively banking application and perform a transfer using this platform as an option. The money will be sent directly to the bank account of the recipient, and it works even if the receiver does not use any online digital payment platform. The send will be receiving an email to confirm that the transfer was a success.

Local and international transfers are completed within a day. This is a great improvement when compared with traditional banks, wherein transfers can be completed after three to seven working days, which is slow in today’s standards.

Advantages of using Wise

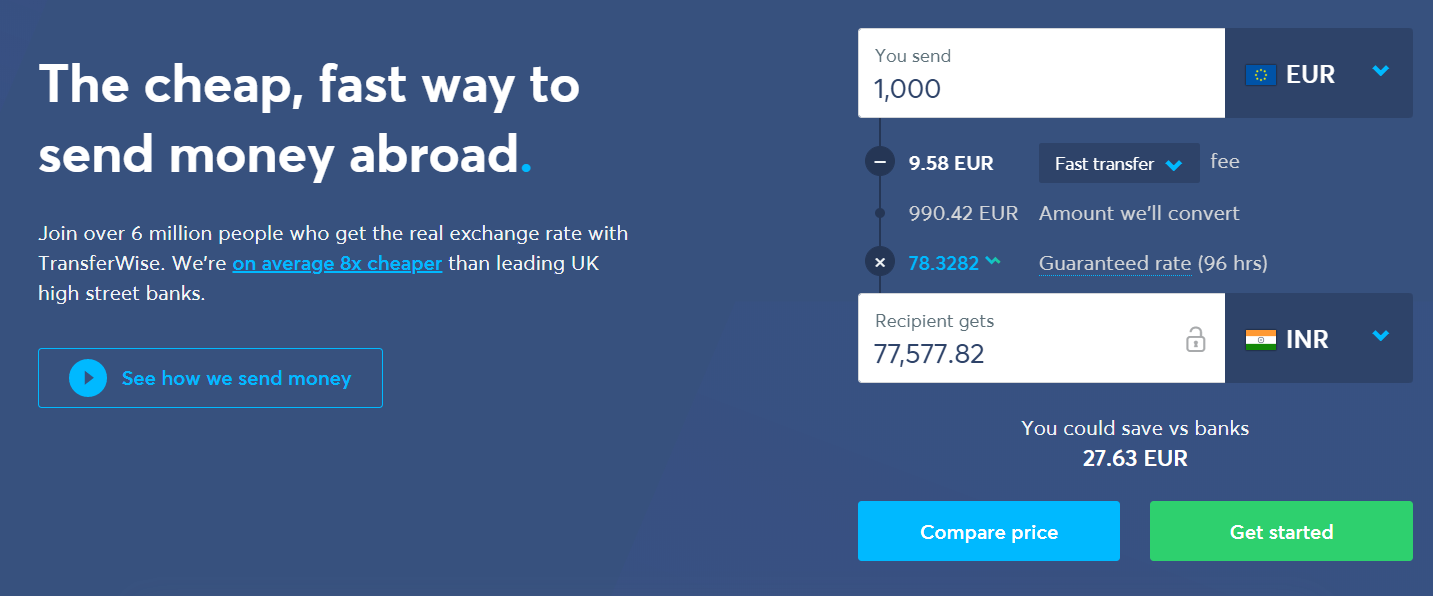

One of the advantages pointed out by the users of this platform is the lower fees involved in transferring money. It is eight times cheaper compared to a regular bank, and senders will be able to save a lot if they will resort into using this platform regularly. There are other competitors in the market right, which includes Skrill and Neteller, but Wise is making sure that they are keeping their prices competitive to reach more markets.

Another advantage would be their transparent listing of the costs. The company is making sure that all of the fees are documented, and they do not false advertise just to get new clients. The company is not used to charging their customers with hefty fees filled with hidden charges.

The transfers using this platform are faster than what a regular bank can promise. The money transferred using this platform is expected to arrive at the recipient’s local bank account within 24 hours. In Europe, many users are saying that 90% of all the transfers are being received in the same day. 25% of the transfers from the United Kingdom to the rest of Europe are completed in seconds.

Online transfer is also an advantage for the company, because they are providing their clients with new methods on how they can send and receive money. Using online banking application would enable the use of these services.

This platform also has an increasing number of patrons – it is believed that there are now five million people who regularly use the app or website offered by the company for them to send and receive money. No matter if the transfer is for business or regular use, the company ensure that everyone who will be using their services will feel more convenient with the fast transfers and the lower fees that they offer.

Expanding on a global reach

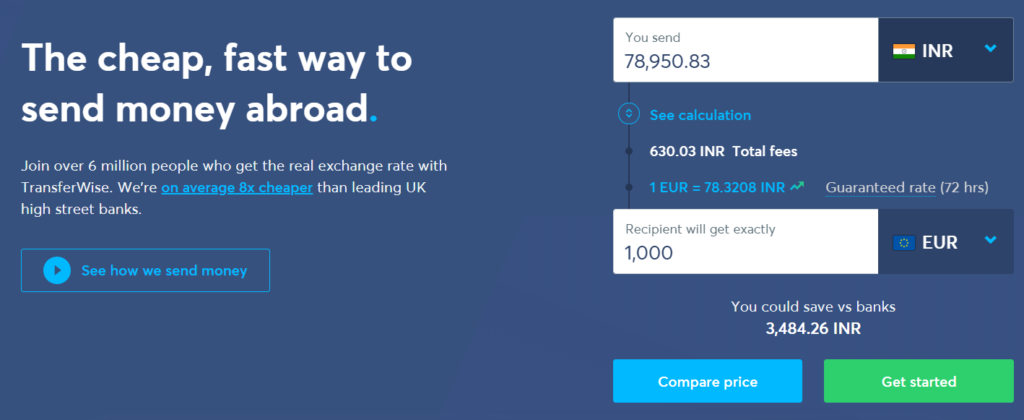

The company is known for their bold decisions when it comes to their operations. Originally operating within the European continent, the company has now expanded their services to all continents around the world. One of the latest changes that the company introduced would be the availability of their services to India. Operating a digital payment services to this huge market can be an advantage for the company. Many overseas Indians are using digital payment transfers to send money to their families back home, but most of the money that they sent is being charged with hefty fees. With the rise of digital payment transfer systems, this problem has been addressed and people back in India are receiving more money than how much they were used to in the past.

The company also revealed that they are not making money by manipulating the exchange rate of two currencies – the money received by the users are based on the current exchange rate on the market. The only way that the company is earning money is through their respective fees. This is another reason why many Indians are now switching to Wise because they knew that using it would give a higher value for their money. This resulted to an increase in online transactions made in India – people are now more inclined to buy items online because they have a reliable platform that they can choose to pay for the items that they bought.

Limitations of Wise in India

People should be aware that there are limitations in using Wise platform in India. Since they started their expansion into the South Asian country, Wise focused on transfers focused on one local bank to the other. Indian rupee (INR) transfers can be sent to local bank accounts, but it will never work if sent to charities in the form of donations. Another limitation of using the platform would be the limit of how little or much can be sent within a day. The current limitation is at least 50,000 or at most 650,000 Indian rupees. Despite the limitation, business owners and people are still inclined on using this platform because the advantages outweigh the disadvantages.

Indian Government supporting Wise

The Indian government is supporting the revolution in payments with respect to digital payment platforms. The Reserve Bank of India stated that they will also support customers who will resort into using these platforms, and they are optimistic that it will encourage the growth of local trade. The Reserve Bank of India refers to these services as IMPS, which is an acronym that stands for Immediate Payment Service. Many people are resorting to these platforms in India because of the faster transfer rate – usually completed within a day. Holidays and weekends would not affect the transfer because the service is available 24/7.

The future of Wise in India

Experts are optimistic about the future of digital payment transfers in India. They knew that more people will be using it in the future, and local developers are also trying their best to enter the market. Wise stated that they are looking forward to serve the majority of the Indian population, which is one of the largest markets in the world alongside China. The company will be improving their services to make the transfers faster and cheaper, and they also understand that internet connectivity is a great concern for some of the territories in the country. They revealed that they will do their best to improve the services in these areas to serve more customers. People in India are delighted knowing that the company is ready to improve their way of life by promoting the improvement of internet connectivity to make their transfers more efficient.

Conclusion

The banking industry found a serious competition with digital payment platforms, and for them to stay relevant in the market, they have to introduce changes that would be beneficial to the public.

JOIN WISE HERE