About the company

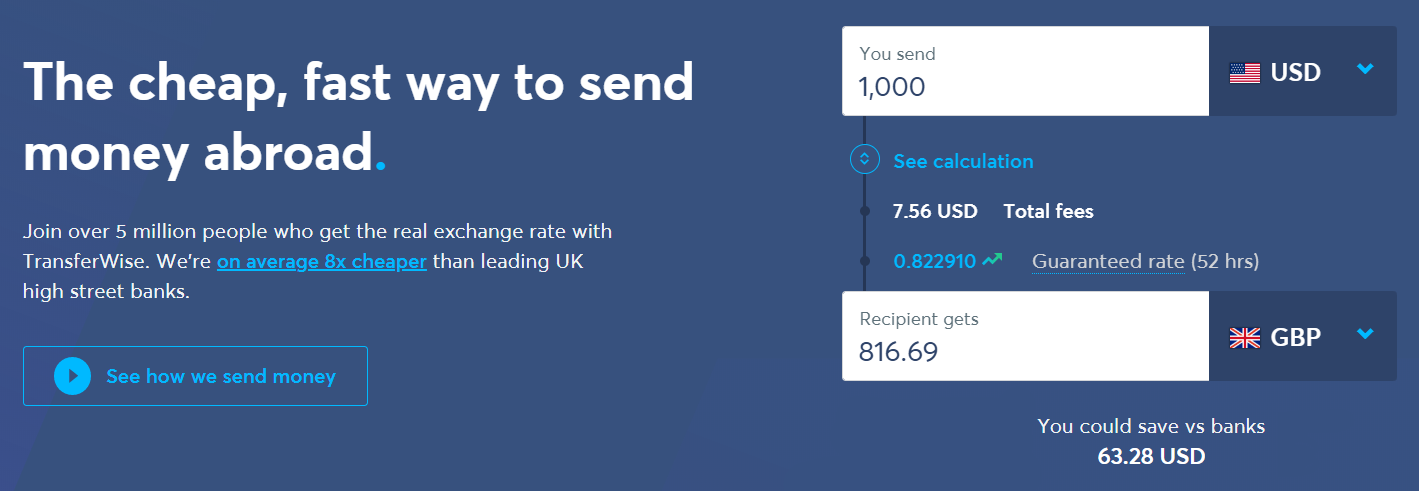

TransferWise is a London based money transfer service with a fast growing international reach. The company’s localized approach to service provision is modeled on transparency and low cost pricing. Users also enjoy ultra-fast currency exchange services with no hidden fees. With over 4 million customers, the company’s international money transfer service is up to 8 times cheaper compared to banks. The service currently covers 49 currencies transfers and over 1300 currency routes.

In March 2018, the company reported a net profit of $8 million. Statistics also show TransferWise is doubling in size every 12 months. All this has been made possible by a tireless workforce of more than 1200 employees. The company entered the market in 2011 at a time when the global money transfer market was broken. Aside from the prevailing low money transfer costs, customers have had to contend with slow transfers, hidden fees, inadequate customer support and inconvenient end-user experience.

Here are the top reasons for TransferWise speedy growth:

• Low, clear and transparent pricing business model

• Opportunity to send money using real exchange rates

• Speedy and efficient money transfers

• Convenience of using Apps and desktop computer to send money

• High customer service rating (Over 6,000 5-star reviews on Trustpilot)

The company also provides a Borderless Account and Card. The account can be used to hold and manage over 40 currencies. Customers are not required to pay monthly fees and receiving fees for this service. The other popular offering is an elaborate partnership program that allows affiliates to earn handsome commissions by promoting the service. Details about the partnership are available on the company website.

Market comparison

The international money transfer market has been growing year-on-year. In 2017, a total of $690 billion was transferred internationally by individuals living in various countries. TransferWise currently transacts $5 billion a month to more than 70 countries. Sending money internationally has long been the preserve of a few established companies. As an entrepreneur who frequently travels and sends money around the world, getting a reliable, low cost partner hasn’t always been easy.

For instance, the process of transferring money between PayPal and bank has often been long and painstaking. You are first forced to sign up for more than one account and each transfer you make is charged at exaggerated exchange rates. I was glad to discover that TransferWise only charges a paltry 1% per transfer. This translates to a fee of $10 when you send $1000. Even if you use your credit card as a funding source to send money, the company still charges the same percentage rate.

With international banks, you can expect rates as high as 10% when sending money internationally. Banking institutions are also notorious for hiding cost under the exchange rate. It dawned on me that most banks actually set their own exchange rates to maximize profitability at the expense of the customer. People are naturally drawn to the cheapest money transfer services available. This is the reason many are shunning the banks for speedier, low priced cash transfer options in the market.

Below is my brief assessment of how the leading international money transfer service stack up against each other based on cost of service, convenience, security and transfer speed:

Cost

The Western Union exchange rates are up to 6% higher than the mid-market rates. Its maximum transfer amount varies from one country to the other. The fees are much higher for customers using debit or credit card to access cash payments. As a concession, the company offers affordable services such as fee free transfers to certain high traffic remitting countries. The PayPal’s fee are also comparatively higher compared to those of TransferWise.

The former usually adds 2.5% to 4% extra cost on top of the exchange rate that you end up receiving. The exchange rates exercised by TransferWise fall in the middle market range and attract very minimal transfer fees. The transfer percentages fall in the range of 0.5% to 2.35%. The fee is calculated based on where and how you plan to send the money.

Speed of transfer

When you transfer money on TransferWise, you can expect the entire transaction to be completed in 1 to 4 business days. The speed is even faster for USD and EUR transfers as this only takes between 1 to 2 business days. For PayPal, a similar transaction takes between 3 to 5 business days to complete. The speed of transferring money with Western Union can take few minutes to several days. The quickest service is offered at very high rates while the cheapest services options could take up to 5 days, depending on the destination.

Service convenience

It is relatively fast and easy to sign up for an international money transfer service. Established companies often use their extensive network of agents alongside the online and mobile presence to leverage their services. TransferWise, on its part, is expanding aggressively and working constantly to make its platform as user-friendly as possible. For instance, users can easily log into their accounts using popular sites like Google and Facebook.

Security

Security is undoubtedly the single most important consideration when sending or receiving money. All the money transfer services rank high when it comes to security and adherence to international security codes. The safeguards have gone a long way to ensure effective authentication; better user control of payment patterns and improved support from third-party security teams. This is a huge plus for anyone who decides to use a different service.

Conclusion

Established money transfer services have long dominated the market. However, the emergency of new entrants is shaking things up to the benefit of the consumer. Besides growing fast, TransferWise charges reasonably lower fees, competitive exchange variations and guarantees speedy transfer services. The peer-to-peer system of operation helps the company keep the cost low since the exchanges target peers or other customers rather than banking institutions. If you want to learn more about the money transfers and other service benefits, visit the company website.

JOIN WISE HERE